Typical Documentation Needed for a Financial Plan

Everyone's financial and personal situation is unique. Regardless of the individuality, a common document list is needed to start the process.

Background

One of the most interesting aspects of being a Financial Planner is the very uniqueness of every Client relationship. Even in my given niche — Senior Military Members near or into retirement — there is a very high degree of variability amongst individuals. Some are married, some are single, and others are divorced. Inheritances, savings habits, and spending habits have left no two individuals - whose military earnings are nearly identical - in the same financial spot.

Whatever the case, the documents behind the initial conversation bring exactness to the generalities typically touched on during introductory meetings. For Resilient Asset Management, we have collated a list of desired documents in order to formulate the building blocks of a cogent Financial Plan for our Clients.

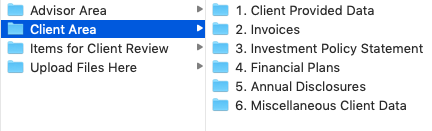

As part of our service model, Resilient Asset Management provides our Clients with access to a secure on-line ("The Cloud" in IT parlance) folder to both upload and store these documents. The structure looks about like the following:

In addition to the security provided through this mechanism, this process also enables robust, customizable information sharing between the Firm and the Client, which is so essential in crafting Client Financial Plans.

Estate Documents

A current Estate Plan is frequently one of the areas needing attention for our Clients. To get started, we normally like to see the following:

- Will

- Trust

- Power of Attorney

- Medical Directive

- HIPPA Directive

If a Client does not presently have Estate Documents in force, we of course recommend retaining the services of a qualified Estate Attorney to work with the Client to execute the above documents.

When Resilient Asset Management receives these documents, we review them for completeness and make note of areas that might need attention. Some of the more common items noted are as follows:

- Out-of-date Will not accounting for new family members, i.e. Children

- Named Guardians who are no longer alive (or capable), i.e. Grandparents

- Former spouse given a General Power of Attorney

- Real Estate not properly titled after a divorce

- Medical decision authority given to an ex-spouse

- Trusts that are not properly funded

- Improperly executed documents

This is not an exhaustive list. The point here is to have a second set of eyes review your Estate Documents for adequacy, completeness, and accuracy. Then, to do a review each year to ensure the plan is still relevant and to update when necessary. Indeed, updating a plan is far less cumbersome than starting from scratch — a point about which any Joint Staff Planning Officer is keenly aware.

Insurance Documents

Assessing Risk Management is one of the many value propositions a Financial Planner can offer Clients. Indeed, risk comes at you from all angles — seen and unseen. In some cases, as with Auto Insurance for example, we are all schooled from age 16 onwards about the importance of "being covered". In other cases, as with Long Term Disability, wisdom is frequently garnered through experience, where unfortunately you take the test first and receive the lesson only afterwards. Therefore, seeking the assistance of a Financial Planner might mean side-stepping a few financial potholes - certainly worth pondering. The documents we ask for are as follows:

- Auto Insurance Policy Statement

- Homeowner's (or Renters) Policy Statement

- Umbrella Insurance Policy Statement

- Health Insurance Policy Statement

- Life Insurance Policy Information

- Long-Term Care Insurance Policy

- Annuity Information

- A Statement of Employer-Provided Coverages

Specific Clients may have insurance coverages not specified above due to their unique circumstances. Whatever the case, the above documents are a great start to formulating the Client's risk posture. Resilient Asset Management reviews all the documents and drafts an Insurance Coverages document for the Client. We also note areas needing attention, which may include the following:

- The absence of a recommended coverage, Umbrella and Disability are common

- Life Insurance policies that have lapsed

- Out-dated Life Insurance beneficiary, i.e. an Ex-Spouse

- Inadequate Auto Insurance, i.e. Coverage is too low

- Homeowner's Policy with a very low deductible, and thus a higher premium

- Not utilizing free coverages offered by the present Employer

- Choosing a Health Care Plan not eligible for a Health Savings Account

Risk Management is a tremendous service to Clients. The aforementioned set of documents can assist your Financial Planner in crafting recommendations to hopefully avert financial catastrophes.

Income Taxes

Individual and corporate tax payers can procrastinate about a great many things. They can also estimate, contemplate, project and what have you. However, with Income Taxes, we are required to "settle up" with Uncle Sam every year down to the exact dollar.

Thus, supplying your Financial Planner with the last few years of Income Tax Returns - there are exceptions if you achieve elected office perhaps - is generally a relatively easy task. And providing your returns to your Financial Planner is not without some potential benefits, for example:

- Overlooked Sales Tax Deduction in Income Tax Free State Residents.

- Missing 401(k) Deductions

- Missing Health Savings Account Deduction

- Missing Charitable Contribution Deduction

- Not including a Medical Expense Deduction

With the Tax Cuts and Jobs Act of 2017, the Income Tax code and forms have changed significantly, so it is even more critical to provide your returns to your Financial Planner for review and comment.

Investment Documents

Some prospective Clients and others seeking financial services have a paradigm of only Investment Management when it comes to seeking Financial Advice. Simply put, they are looking for their parents' "Guy" of yesteryear.

As Financial Services have evolved, so too have individual Financial Planners. Now, "Holistic", "Comprehensive", and "All Aspect" are all the rage amongst a new breed of Financial Planners looking to provide "Fee for Service" advice to their Clients.

All that said, Investments are still a very big part of the Financial Planning process. To provide valid recommendations regarding your investments, your Financial Planner will need the following:

- Taxable Brokerage Account Statements

- IRA (Traditional & Roth) Statements

- Employer Retirement Plan Statements

- 529 Plan Account Statements

- Custodial Account Statements

- Business Brokerage and Bank Account Statements

- Bank Account Statements

These documents will allow your Financial Planner to construct a Net Worth Statement annotating all your financial resources and liabilities. Moreover, your Financial Planner may discover one or more of the following:

- An orphan Retirement Plan Account from a previous employer

- The absence of a needed business Checking Account to separate expenses

- A Custodial Account in need of transfer to an Adult Child

- An Employer or Retirement Account with an outdated Beneficiary Designation

- Over-concentration in Employer Stock within a Retirement Plan Account

- Improperly titled Brokerage Accounts

Despite the changing nature of Financial Services, there is still much value for Financial Planners to deliver to Clients via general investment advice. To provide meaningful advice, a Financial Planner needs all your data.

Cash Flow Analysis

Some Prospective Clients seek a Financial Planner to assist with addressing their excessive spending habits. To be sure, this is another area where Financial Planners can be invaluable. To deliver the goods, your Financial Planner will likely need the following:

- Pay Statements

- Credit Card Statements

- Bank Account Statements

- Mortgage Account Statement

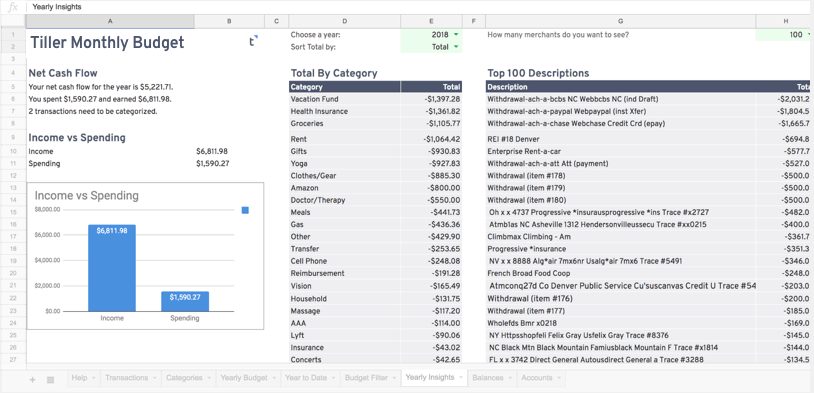

Cash flow analysis can be tedious & exhausting. To assist, some Financial Planners employ data aggregation tools that both collate the data into a single file, typically a spreadsheet. Moreover, the better tools also categorize the data for smoother analysis by both the Client and the Financial Planner. The following is an example from Tiller — a very capable data aggregator used by Resilient Asset Management:

Source: https://www.tillerhq.com/which-tiller-google-sheets-template-is-best-for-you/

The importance of supplying all the data to your Financial Planner cannot be overstated. This is not the area where you want to omit the "secret" credit card account carrying a 5-figure balance! Rather, this is the time to allow all the accounts to see the light of day so your Financial Planner can assist with pointing you down the road of financial prosperity.

Conclusion

The documents listed above are collectively a staggering set of data. However, supplying this information to your Financial Planner will enable him/her to organize your Financial Picture in a cogent way. Furthermore, once your Financial Planner couples this data with the qualitative data you provide through several Client Meetings, he/she will ideally be able to provide you the necessary recommendations to reach your financial goals.

Comments, criticism, and suggestions are always welcome. If you would like to provide any or would like to discuss your personal situation with Resilient Asset Management, please contact us here.