A Stealth Roth IRA for Retirees

The Roth IRA is a particularly attractive account for retirees. Leaving aside how the money may have arrived in one's Roth IRA Account, the funds within the account grow tax-free, have no required minimum distribution (RMD) requirements, and under present (July, 2019) law, can be passed down to heirs who can then stretch their distributions out over potentially many decades. Indeed, a Roth IRA is akin to the Queen in Chess.

Given the ubiquity of literature related to Roth IRAs, I will not delve into the details here. Rather, I wanted to illustrate what today I will call the "Stealth Roth IRA". I am using this name because what I will describe today is not a Roth IRA. Rather, it is a Traditional IRA dressed-up in Roth IRA clothing. I will describe in detail what I am talking about in the following paragraphs.

This topic will be of considerable interest to those who are on the more modest end of asset levels — those who have some money saved, though not enough to make retirement a cinch. That description is necessarily vague as it depends on a myriad of factors. The only one who can truly know is you....and you know who you are.

Background

Recognizing the need and importance of funding the retirements of aged Americans, the United States Government spawned the "Individual Retirement Arrangement" in 1974 via the Employee Retirement Income Security Act. Since then, IRAs and other types of retirement accounts have evolved to the present form of which most are aware today.

With Traditional IRAs, the taxpayer earns a present-year tax deduction, enjoys subsequent year tax-deferred investment growth, and then finally recognizes distributions from the IRA as regular income starting no earlier than 59 1/2 and no later than 70 1/2. The taxable distribution amounts can vary between an IRS-calculated minimum amount and the balance of the entire account. Regardless of how much is withdrawn, all of the distribution amount (there are a few exceptions) is taxed as regular income.

Some Background on Social Security

The average monthly Social Security Benefit in 2019 is $1,461. Moreover, while the actually number may vary depending upon the source of your data, somewhere between 15% to 36% of retirees receive 90% or more of their income from Social Security. Clearly, understanding the rules governing Social Security is essential. Primarily, a firm grasp on when to claim and then an understanding of how Social Security benefits are taxed is required.

For the wealthy and healthy, typically deferring Social Security claiming is the right answer — you simply can't beat the delaying credits you get all the way to age 70. For others — think the sick and financially challenged — claiming as early as possible may be the best (or only) answer. Whatever the case, once you pull the lever on claiming, then you are in the world of how your benefits are taxed.

Earnings Test for Social Security

The Social Security Earnings Test is applicable to those who have already claimed Social Security Benefits who continue to work and earn income. The two pieces of data you need are the amount of income you earned and your Full Retirement Age. Both are objectively determined via your W-2 from your employer and your Social Security Administration determined Full Retirement Age (FRA). For those born in 1960 or later, your FRA is 67. For those slightly older, FRA varies between 66 & 67.

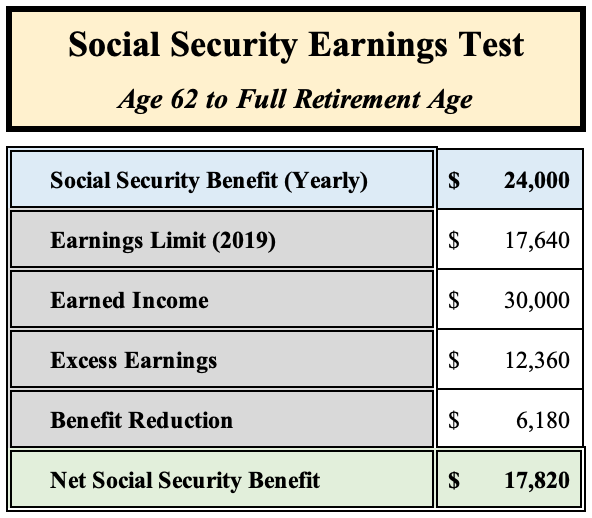

With these two pieces of data, the Earnings Test is as follows:

- Earnings Limit. For 2019, if you earned $17,640, your Social Security Benefits are not impacted.

- If you earned more than $17,640, the next question is about your age:

- You are older than 62 and less than your Full Retirement Age (FRA): you will have $1 of your Social Security benefits withheld for every $2 you earned income in excess $17,640 for the year.

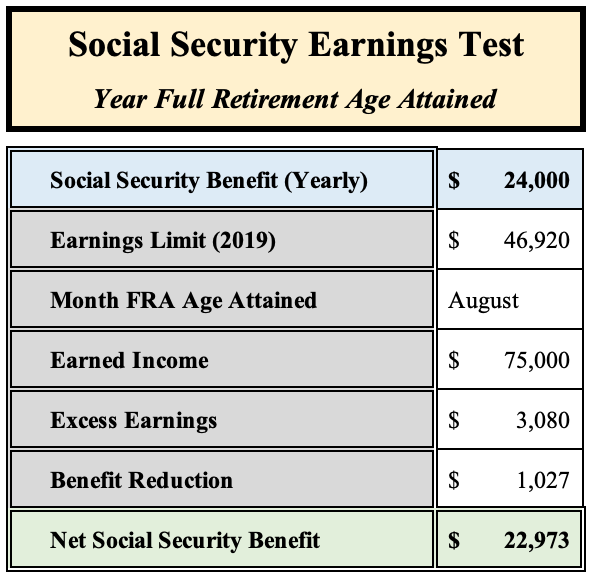

- You will reach FRA during the current year: You will have $1 of your Social Security benefits withheld for every $3 you earned in excess of $46,920 (again, in 2019). And even better, the only income considered is for those months before you reach FRA.

- Your age exceeds FRA: Easy, you can earn as much money as you want and you are unaffected.

Social Security Earnings Test Example 1: Individual less that FRA Age with a $24,000 per year Social Security Benefit and earned income of $25,000.

Social Security Earnings Test Example 2: Individual attaining FRA Age in August of the current year with a $24,000 per year Social Security Benefit and earned income of $75,000.

Income Taxes and Social Security

How Social Security benefits are taxed is one of the more confusing aspects of the tax code. Sadly, the calculations get a bit involved and are anything but intuitive.

For starters, let's bracket. If you have no other income besides your Social Security benefit, NONE of your benefit is taxable. Conversely, if your income — from all sources — exceeds $25,000 Single or $32,000 Married — then fully 85% of your Social Security benefits are taxable. Unfortunately, and this is a very big deal, neither the $25,000 nor the $32,000 number are indexed. Therefore, ANY retiree is best-advised to have a cogent strategy for receiving Social Security benefits.

In the middle. For those in the middle of the two poles, there is much that can be done financial planning wise. Let's look at a strategy of minimizing income taxes. First, a few numbers to consider:

- 2019 Standard Deduction for Singles (65 or Older): $13,850

- 2019 Standard Deduction for Married Couples (65 or Older): $27,000

Let's assume we have a goal of minimizing income taxes to zero for a taxpayer with a Traditional IRA. This goal leads to the question of how much in an IRA distribution could one take such that the distribution would not trigger income taxes.

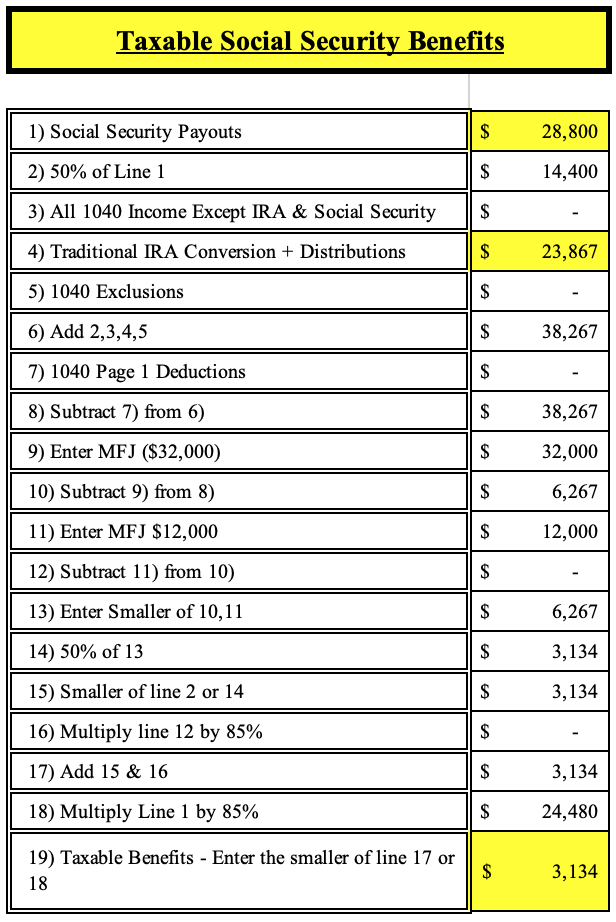

Before getting to the calculation, an understanding of how one determines how much of Social Security is taxed is paramount. Unfortunately, the computation is pretty complicated. For me, I use a calculator and the a brute force method of arriving at the actual number. Here is a snapshot of the calculator I use with the assumption of a married couple receiving $28,800 of Social Security Benefits:

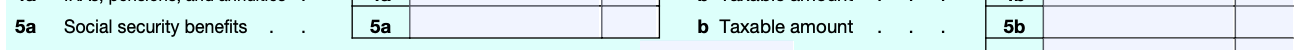

Using the calculator above, if this couple had $23,867 of income from all sources other than Social Security, then $3,134 of their Social Security Benefits would be taxable. They would then enter $28,800 in Line 5a of their Form 1040 and $3,134 on Line 5b as follows:

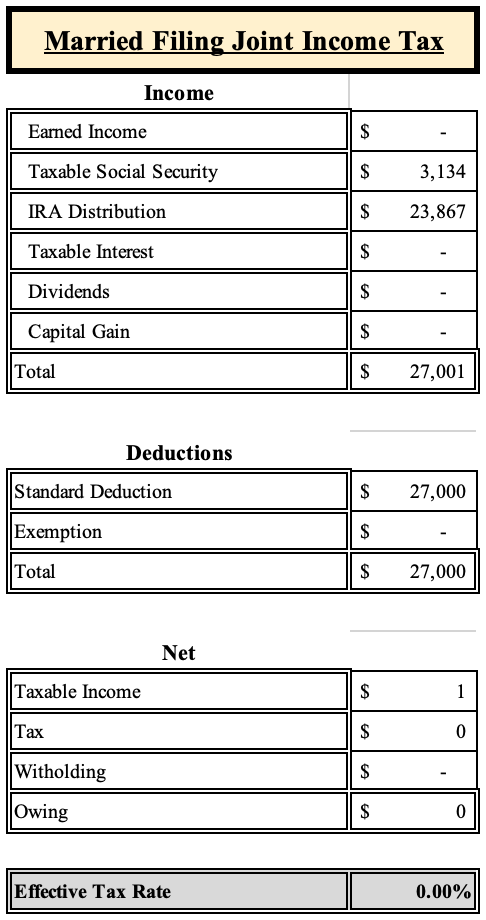

Now you (or your accountant) would take this information and populate the rest of your Form 1040. For illustration purposes, I have a simplified Income Tax Calculation presentation for this same couple, which is as follows:

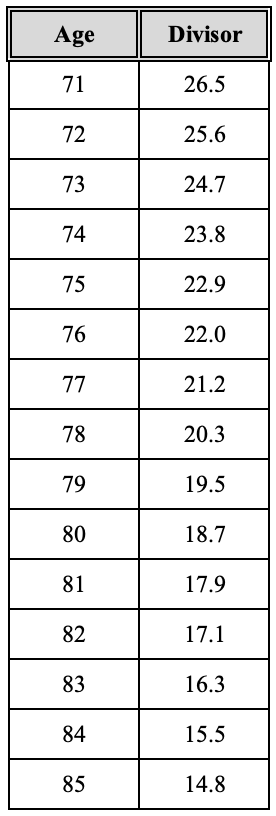

There is no typo...for this couple, they could withdraw $23,867 from their Traditional IRAs and couple that with $28,800 of Social Security Benefits and they would pay no Federal Income Tax. Indeed, with a paid-off house, receiving $51,000+ Income Tax Free is a workable solution for many people. So the next question is: what is the mysterious Traditional IRA balance that could produce this happy result? For this number, we have to go to the RMD Divisor Table — happily produced by our friendly IRS. It is as follows:

The numbers vary slightly for those who turn 70 1/2 in the early part of the year, though the differences are minor. The salient point here is that these are the numbers by which your Traditional IRA balance is divided to arrive at your Required Minimum Distribution.

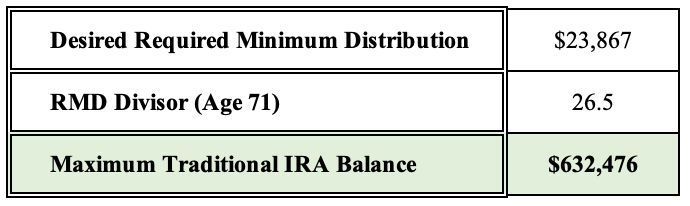

So, let's go back to our $28,800 Social Security Benefit couple looking to minimize their Income Taxes. The calculation is relatively simple...we will assume only one of the couple has a Traditional IRA and that she is Age 71 in the year of the calculation. Here are the numbers:

We arrive at the answer by simply multiplying the RMD by the Divisor. In this case, $23,867 * 26.5 = $632,476.

The takeaway here is that for this couple, the last $632,476 is effectively a "Stealth IRA" in that their distribution is effectively tax-free just as a Roth IRA distribution would be. This happy result is a direct byproduct of the beefed-up Standard Deduction recently enacted as part of the tax code. Fortunately, the Standard Deduction is indexed each year for inflation. However, this couple must also account for the change in investment values throughout each year and a myriad of other factors.

Things to Consider

1) Married Couples Will Not Enjoy the Same Standard Deduction Forever

Obviously, we won't live forever. So inevitably, a Married Filing Jointly couple will eventually become only a Single Filer. When this happens, the Standard Deduction is decreased by about half, thus the mathematics that worked in the Couple's favor above will work against the Lone Survivor. Therefore, careful planning is recommended to prepare for the demise of each member of the marriage. More on that in a minute.

2) The RMD Divisor decreases every year

With the RMD Divisor decreasing every year, there is significant potential for the RMD to become a significant tax factor. That is, you are dividing your account balance by a smaller number, thus the taxable income will be higher. True, the Standard Deduction is also increasing, though if you look at the $632,476 balance above and assume an 8% return, the RMD for the following year is $25,675. Thus, careful planning is required to account for both the increased RMD and the potential for rates of return that can move the income tax needle.

3) Keep Other Methods in Mind for Decreasing the Traditional IRA Balance

If the Traditional IRA balance is too high, this is not a horrific result. In fact, it's good....so don't feel so bad. If you find yourself in this happy dilemma, then you can consider other ways to play offense. For example, you could consider use of the Qualified Charitable Distribution (QCD) as a way of giving in a very tax-efficient way. Moreover, you could tilt your asset allocation so that assets with less potential for significant capital appreciation — think fixed-income — are located in your Traditional IRA. Concomitantly, you would locate your higher-potential assets — think stocks — in your Roth IRA.

4) Consider Delaying Social Security as Long as Possible

While everyone's situation is unique, in many cases, deferring Social Security is a wise option. While some cannot wait to get their hands on "their money" when they turn 62, frequently those doing so pay a heavy price when making this choice. Simply put, you cannot beat the guaranteed, tax-free benefit of delaying Social Security. Therefore, for those with an appreciable amount of tax-deferred assets — either in a 401(k) or a Traditional IRA — your 60s are the time to get busy financially. Before pulling the lever on Social Security, it is strongly recommended to talk to a financial professional.

The Final Point

The net of all the calculations and explanations here is to illustrate that the last part of the Traditional IRA could come to a retiree income tax-free — a Stealth Roth IRA. While this may mean nothing to some, it can be the cornerstone of a Financial Plan for others. Without getting into further gory details, for those in the $400,000 to $600,000 range of assets in Traditional IRAs and no other income sources or assets, I target having about $200,000 in Traditional IRA assets with all other assets being converted to a Roth IRA.

If you start early enough with assets above that level, I encourage either Roth IRA conversions, which are an exceptional planning tool, and simply using the assets in lieu of taking Social Security Benefits. This is why the decade between ages 60 and 70 are so ripe with Financial Planning opportunities. This is where Holistic Financial Planning runs circles around those who only manage investments for a living.

Conclusion

We covered a lot of ground here. The net of all of it is that if you have not thought through how you are going to fund your retired years, you could be making an expensive mistake. For those at asset levels that are borderline in terms of being able to shoulder a multi-decade retirement, you are the most vulnerable. Therefore, speaking to your trusted tax professional or seeking out a competent Financial Planner may be something to which you should give ample consideration.

Comments, criticism, and suggestions are always welcome. If you would like to provide any, please contact me here.