A Simple Tax Avoidance Strategy for Parents

Taxes are a four letter word for most people. In my service as a financial professional, income taxes — or of any kind for that matter — are one of the more detested line items in Client budgets. Of course, few people "like" paying taxes. Therefore, in keeping with Judge Learned Hand's famous quote, “Anyone may arrange his affairs so that his taxes shall be as low as possible”, here is a simple strategy any parent can consider.

Multi-Year Bull Market

Defining the definitive start of a Bull Market — a period of generally rising stock prices - is something of a moving target. The current Stock Market - by most definitions — has been a rather long steady ride of increasing prices. True, there have been brief periods of setbacks. However, from March 2009 until now (May, 2019), the rise has been decidedly upward in aggregate.

As a consequence of this remarkable bull run, most investors should be sitting on a stockpile of capital gains. Some of these gains are safely tucked away in tax-deferred (Traditional IRAs & 401(k)s) or tax-free (Roth) accounts. Conversely, some reside in fully taxable accounts, which are where we will focus today.

A Few Words About Tax Rates

To be sure, capital gains are a great problem to have. For starters, capital is treated much more favorably than labor in the current tax code. More specifically, the maximum long-term capital gains rate is currently 23.8% – 20% Capital Gains plus 3.8% Medicare surcharge...not everyone pays the 3.8%. Labor, conversely, is taxed at a maximum 37% rate...I am talking about your W-2 income here.

I have no comments on W-2 tax rates....if you make more, all the more power to you. Minimizing taxes on earned income is a separate topic for a different day.

For parents with Long-Term Capital Gains, there is a simple strategy you can employ to offset and possibly avoid capital gains taxes altogether.

Tax Rates for Minors

For starters, this article is for informational purposes only. If you are in doubt about your income tax filing situation, please consult with your tax professional.

The Tax Cuts and Jobs Act dramatically changed the way a Minor's income is taxed. Presently, parents have to consider three basic questions for a Minor's Income

- Is you child considered a minor?

- What type of income does your child have?

- How much income is there?

Minors are generally defined for tax purposes as follows:

- Under 19 (24 if enrolled Full-Time as a student)

- Lives with you more than 50% of the year

- You provide greater than 50% of your child's support

Earned Income. The requirement for filing an income tax return depends on how the income was earned. Generally speaking, it could be self-employed, think mowing lawns. Or, it could simply be regular earned income, think of a part-time job at Burger King (hey, I worked there as a kid). If in doubt, ask your tax professional.

I will not focus any more on earned income since this consideration neither applies to most children nor is it a focus point of this article.

Unearned Income. Here, we are talking about investment income. Before talking income tax rates, it is very important to note that the rates listed below only apply to the income exceeding $2,100 of unearned income. Remember, we are only talking unearned (i.e. Investment) income here. The net here is that you essentially get a $2,100 deduction on a minor's unearned income.

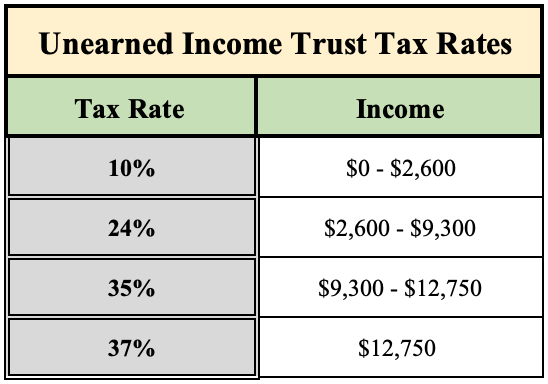

The recent changes in the tax code dictated that minor unearned income is taxed at trust rates, which are as follows:

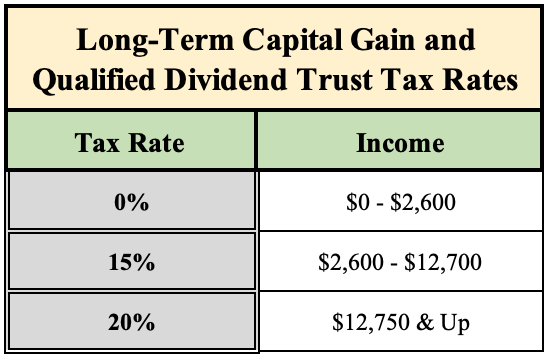

Adding another wrinkle to the puzzle, there are also Long-Term Capital Gains and Qualified Dividend Tax Rates for Trusts. There are as follows:

Using the table above, we can see that you can effectively shield $4,700 of Long-Term Capital Gains and Qualified Dividends from taxation - the first $2,100 is not taxed (see above) and there is a 0% rate on the first $2,600. This calculation is the central focus of the tax strategy I will demonstrate below.

Rules on Gifting Appreciated Assets

Minor's cannot have their own investment accounts outright. Instead, parents must establish a custodial account in their child's name. This is done via either a Uniform Gift to Minors Act Account (UGMA) or Uniform Transfer to Minors Act Account (UTMA).

Once an account is established, any assets that go into the account are an irrevocable gift to the minor and must be used for his/her sole benefit...tuition of any sort qualifies as for the child's benefit. Moreover, any assets transferred into the account maintain the parent's basis. For cash, that is simple, the basis is the amount of the gift. With securities (think appreciated stock), the basis remains what it was for the parent. That is, if you gift $10,000 worth of stock for which you paid $5,000, the child's basis remains at $5,000 and upon sale amounts above this basis will be taxed at the rates noted above.

To complete the explanation, a parent may gift up to $15,000 per calendar year to their child via an UTMA/UGMA. Gifts above this amount are permitted; however, this creates a reportable event and you should most definitely consult your tax and legal advisor should you choose to gift amounts above $15,000 in a calendar year.

An Illustration

To this point, the discussion has been mostly academic. I think an example will tie all the various points together and detail the strategy I am trying to convey.

Assumptions:

- Stock Basis: $5,300

- Current Market Value: $10,000

- Parent Capital Gain Tax-Rate: 23.8%

- Amount Needed for Child's Tuition: $10,000

In this scenario, the parents could consider doing the following:

- Transfer the Appreciated stock to the child (this amount is below the IRS Gift Limit of $15,000)

- Sell the appreciated stock (This triggers a Capital Gain)

- Use the proceeds to pay the Tuition

By doing this, the parent is avoiding $4,700 in Capital Gains Taxes. More specifically, the income tax savings are $4,700 * 23.8% = $1,118.60. This is real cash savings. And even better, the parent can use the funds she would have used to pay the tuition to replace the appreciated securities in her own portfolio.

Income Tax Return for a Minor

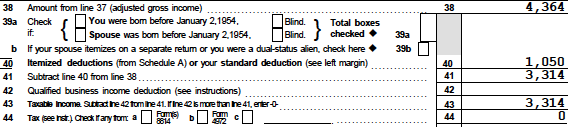

You should know, using this strategy requires filing an Income Tax Return for your child. This process includes the completion of IRS Form 8615 and the tax associated tax computation worksheet, which is not the most intuitive form ever created. Bottom line though, it is absolutely worth it. It works...on my son's 2018 Income Tax Return, he was credited with $4,364 of Long-Term Capital Gains and Qualified Dividends. Here is an excerpt from his actual 1040 showing taxable income of $0:

So long as the rules remain as they presently are, I intend to continue gifting funds to him annually and using the proceeds for his benefit. I'm not worried - he is 3 years old now and I understand there are countless fees and bills in our future.

Other Points to Consider

1) Future Capital Gains

Once the assets are gathered into the UTMA or UGMA Account for Junior's benefit, they will enjoy the same $4,700 shielding of income every year. Thus, it makes tremendous economic sense to harvest the Capital Gains each year to re-establish the basis. So long as the gains are less than $4,700, there are no income taxes due. In the financial planner parlance, this is referred to as "Capital Gain Harvesting". It is like "Tax Loss Harvesting", but much more enjoyable since you are selling winners rather than lamenting losers.

2) Be careful of the Trust Tax Rates

To best-employ this strategy, it is best to avoid short-term and non-qualified income. This is due to the tax treatment these forms of income are given, which is considerably more than the preference given Long-Term Capital Gains and Qualified Dividends. More simply put, if you stick to the tried and true Equity Index Mutual Funds, you will keep your expenses low, most likely generate low tax cost Capital Gains over the long-term, and generate funds for your child's use. It really is a sweet deal.

3) Going Overboard on Capital Gains

On the off-chance that your gifted assets appreciate to the point that the Capital Gains exceed $4,700 in a given year, there is absolutely no need to worry. UTMA and UGMAs are designed to convert to the child's ownership at either 18 or 21 depending on the state where the gift was made. Once this happens, the account converts to a Standard Brokerage Account for the child, who is an adult for tax purposes. Once this occurs, the Trust Tax rates go out the window and Junior can enjoy the benefits of the tax code on his/her own merit. Moreover, the assets retain the same tax basis.

Typically when children enter into adulthood, his/her salary is at the low end of the income tax structure. As of 2019, the Capital Gains rate for a Single Filer is 0% up to $39,375. There is a bit that goes into the tax computation I will skip here. My point is that Capital Gains 0% brackets for young, low earners are considerably wider than for minors. So, if Capital Gains stack up, don't fret, the tax saving opportunities improve in young adulthood.

4) Use of UTMA in Combination with a 529

Some parents may want to consider employing a 529 in concert with this strategy. The only add-on to the checklist would be after you "Tax Gain Harvest", you transfer the account to a 529 Account. Once there, they funds grow tax-free so long as they are used for qualified expenses.

One super-important caveat here is the use of funds. If you move UTMA funds to a 529, the funds must be used for the Child's (UTMA Account Beneficiary) benefit only. This is different than a regular 529 Account where the parent owns the account and can modify the beneficiary to another family member.

Conclusion

Practically no one enjoys paying taxes. Moreover, the costs of raising a child are eye-watering — in many ways. Therefore, every little bit helps. To be sure, the tax avoidance described here is not a panacea. However, some financial benefits are at the margin, which for many families can mean a lot.

Please make sure you fully understand this strategy before you try this at home. Your accountant is your friend here, so please be sure to refer to him/her beforehand.

Comments, criticism, and suggestions are always welcome. If you would like to provide any or would like to discuss your personal situation with Resilient Asset Management, please contact us here.