The Power of Prodigious Savings

Quick Question: Over a 10-Year Period, would you rather double the average savings rate or outperform the market by over 4%? Ponder that for a bit before we come back to it.

Background

During the first quarter of 2024, the combined 401(k) Savings Rate – the sum of employer and employee contributions – climbed to 14.2% of Gross Pay. Of that total, 9.4% came from the employees and 4.8% came from employers (c’mon employers!!!). (Source). This data comes from 26,000 401(k) Plans and almost 24 million employees.

This is wonderful news for savers – as we will see, the amount you save is typically the biggest contributor to ending account values over the long-term.

Investment Outperformance

We all want to outperform the market, me included I confess. Unfortunately, only one out of 10 investors can be in the Top 10%. And even worse, as Investors, there are market dynamics decidedly outside our control that tremendously influence investment returns.

A common investment selection for Investors is the Mutual Fund. Doing a rudimentary search, I arrived at one of the top diversified (repeat diversified, not sector) mutual funds – The Fidelity Growth Company Fund (Ticker: FDGRX). Theremarkable fund returned 18.79% over the past 10 years (from June 6, 2024). This compares to the fund’s comparative index return (The Russell 3000 Growth Index) of 14.55%. The relative outperformance of this best of the best mutual fund was (18.79% - 14.55%) = 4.24%.

Any long-term market participant knows that a 4.24% 10-Year outperformance is a rarified achievement few can attain. And while I do not work at Fidelity, I can imagine the amount of effort exerted to achieve that result was indeed extraordinary.

Savings Outperformance

Savings are a decidedly trickier target as considerable more variables are in play. By and large, the more one earns, the greater the savings rate. In 2024, to be in the top 10% of earners in the United States, a household (two incomes) needed $191,406 of income (Source).

To simplify things somewhat, we will use 9.4% savings rate noted above as “average” for the Top 10% qualifying income amount.

Comparisons

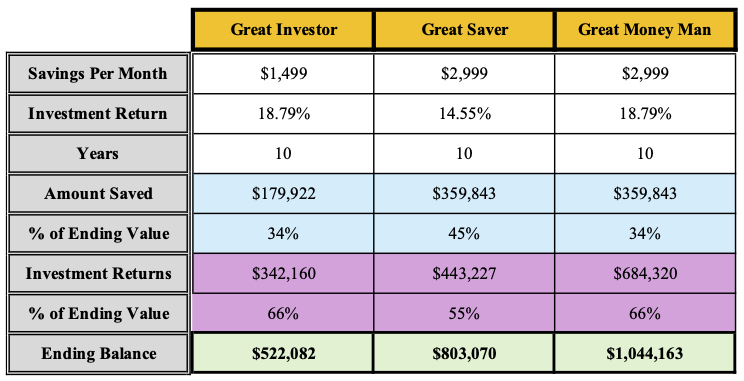

Getting back to the question I posed at the beginning – essentially, would you rather be a great saver or great investor – I present three basic avatars:

The Great Investor – outperforms the market, but only an average saver

The Great Saver – earns average market returns, but is a prodigious saver

The Great Money Man – is both a great saver and remarkable investor

For this illustration, we will assume the income and performance numbers above and define a Great Saver as one who doubles the average savings rate to populate the chart below. Of note, 9.4% of $191,406 equates to $1,499 of savings per month.

As you can see, the benefit of being an above average saver is indeed powerful. In the sample above, the Great Saver has fully 53% more in ending account value compared to the Great Investor.

Of course, the ideal outcome is The Great Money Man. However, this species is rare – we simply can’t ALL outperform the market. And looking further at the numbers, The Great Money Man is “only” 25% ahead of the Great Saver.

Interestingly, for the Great Investor to catch-up to the Great Saver’s ending account value relying solely on investment performance, he really has to bring it. To achieve the same $803,070 ending value based on the same assumptions above, the Great Investor would have to return nearly 10% more per year every year. As a bit of comparison, when Warren Buffett formed his investment partnership in the 1960s, his initial goal was to outperform the Dow Jones Index by 10%.

Takeaways

In numerous prospect calls, I’m asked about Investment Returns. My answer is always the same – you cannot beat relative performance. Meaning, if I were to blindly tell you I outperform the market by 3%, that may seem stupendous. However, what if I average -3% while the market is -6% - that's probably not a happy result for the Investor. The key to successful financial planning is identifying and then achieving one's goals, not simply beating the market. For most of us, the meat and potatoes way to achieve the ending values we want entering retirement, disciplined savings is the key.

So to the investment return question, I typically counter with my firm’s focus on fastidiously tracking Net Worth while emphasizing systematic savings. Over time, particularly while individuals are accumulating for retirement, the focus should be on increasing Net Worth by all means available - savings, job promotions, investments, etc. And the inputs over which we have the most control – spending and saving – should be constantly measured and monitored. Investment returns, especially if you throw in the towel and settle for being “average”, typically takes care of itself.

Seeking High Returns can be dangerous

For a given Investor, there may be times where an investment is made where the probability of a total loss is significant. With the same investment, the returns would likely put the greatest Mutual Fund performance to shame. Think of a business start-up – for any start-up, the probability of failure is high, though the potential rewards are concomitantly handsome. Because of this excessive range of outcomes, one should size such a commitment appropriately – that is, don’t go financially all-in on the Food Truck start-up.

With Marketable Investments, I define a loss as a permanent loss of capital. Quotational Losses – differently stated as market fluctuations – are a different animal. One may invest in the S&P 500 and see negative returns in the first year or several years. Over time, that Index has always come back to reach ever-higher levels, thus no permanent loss of capital results over the long term.

If you are seeking index-beating performance, that may draw you to the more adventurous investments – Private Equity, Venture Capital, Micro-Cap Stocks, Individual Stocks, etc. In this world, the increased Capital Risk in no way guarantees market-beating performance. And in some cases, a permanent loss of capital can result - think Long Term Capital Management, Enron, or Lehman Brothers. Therefore, if venturing into these asset classes, one should strongly heed the truism that if you want to be on the right side of the bell curve of performance, you have to be willing to be on the left side of it as well.

In Closing

With investing, there are few things sweeter than achieving market-beating returns, particularly when it is the result of exhausting due diligence. This outcome is not at all given, and disappointments are inevitable. Fortunately, being an above average saver is something within all our collective wheelhouses. So if you are going to beat yourself up or pat yourself on the back, do it because of your savings rate and NOT because of investment performance. And for those seeking a Financial Professional, I’d suggest looking for one who can assist with maximizing your savings rate. As you can read above, doing so can be seriously beneficial to your financial health.