Navigating the Amazon 401(k) Plan

Employer Retirement Plans form the backbone of most Individual's Savings and Retirement Plan. Where a Defined Benefit Plan used to provide retirement security via "income for life", now most people rely upon a Defined Contribution plan for retirement security. Like most 401(k) Plans, Amazon's is chock-full of bells and whistles that both entice and benefit their Employees. Any Amazon Employee would be wise to be well-versed in Amazon's 401(k).

Basics

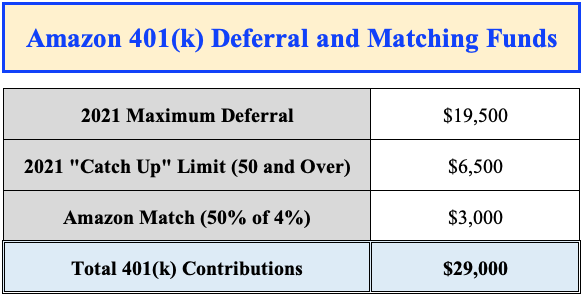

As with any 401(k), Amazon's is governed by ERISA, which limits Employee Deferrals to $19,500 per year as of 2021...this amount changes, usually annually, so be sure to confirm with HR what the maximum deferral amount is for the current year. For those over 50, you have access to the "Catch Up" provision in the tax code, which permits an additional $6,500 in deferrals. Notably, there are no Income or Salary limits to these deferrals - EVERYONE CAN CONTRIBUTE.

For "Matching Funds", Amazon will contribute a further contribution to your account that maxes out at 50% of your first 4% of salary contributed. Not the best in the business, though certainly more than no Matching Funds, which - inexplicably - is policy at some companies.

Here is a chart illustrating the maximum deferral amounts for a $150,000 Salaried Employee:

Beyond the Basics

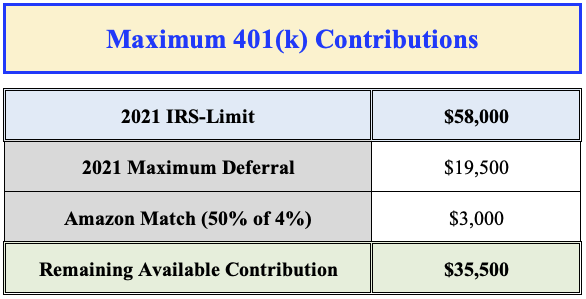

Starting in January, 2020, Amazon permitted employees to utilize "After Tax" contributions, otherwise know as the "Mega Back Door" Roth IRA. Before explaining the mechanics of "After Tax" contributions, it is important to understand the contributions limits. As of 2021, the maximum amount that can be credited to any 401(k) is $58,000. If you are over 50, you can add an additional $6,500 to that for the "Catch Up" Provision. These amounts include the matching funds mentioned above.

Let's assume you are under 50 and earn a salary of $150,000 and want to maximize your deferral....your 401(k) contributions would look like the following.

As you can see, the deferral amount is $22,500 - a tidy sum; however, less than the maximum of $58,000. This is where the "After Tax" Contributions and the remaining $35,500 come into play.

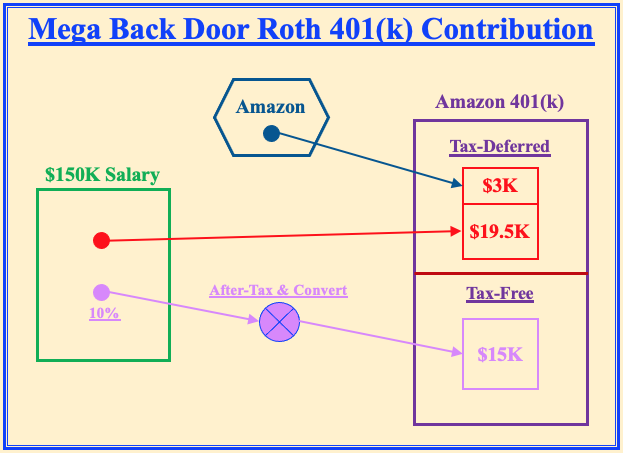

With this strategy, you may contribute - at Amazon - up to an additional 10% of your salary into the "After-Tax" portion of your 401(k). In the above example, that would add $15,000 (10% of $150,000) to your 401(k) contributions, thus bringing the total to $32,500.

Once you make the "After Tax" contribution, you do not want the "After Tax" portion of your 401(k) to generate taxable gains. To avoid this tax calamity, Amazon permits you to convert "After Tax" contributions to the Roth portion of your 401(k). Once there, both the contribution and ALL the future earnings are tax-free under the current iteration of the tax code.

Here is a Chart to Illustrate this point:

Investment Selections

AMazon's 401(k) is administered by Fidelity now, so enrollment will earn you a Fidelity NetBenefits Account. You will have able to administer almost all aspects of your 401(k) account here. The platform has quite a bit of information about the Amazon Plan and Investments in general. The investment menu within Amazon's 401(k) Plan is quite broad and included an array of Index Funds, Target Date Funds, and even a few actively managed funds as well. You can select how all parts of your 401(k) are invested and how often you would like to rebalance, if ever.

All in all, the Investment mix has something for investors of almost all stripes.

Recommendations

1) Contribute the minimum to get the maximum match

Matching Funds are "free money". Essentially, as soon as you contribute 4% of your salary, you earn a 100% return on your money. You will not find very many financial deals in life better than this. Most people should give the 4% deferral serious consideration.

2) Continue deferrals up to the maximum

The next hurdle is the maximum deferral amounts previously described. If your budget can swing it, saving up to this limit is advisable. Depending on other circumstances, you may want your deferrals to go into the Tax-Free or the Tax-Deferred portion of your 401(k). Generally speaking, if you are in the 24% tax bracket or above, maybe tax-deferral makes sense for you. In the lower brackets, the tax-free bucket may make more sense for you. There are a myriad of factors to consider, so please consult your tax or financial professional for specific advice.

3) Consider the "After Tax" Contributions

If you have the financial capability to defer beyond the initial limit, the "After Tax" option is quite attractive, especially if you have ample funds in regular taxable investment accounts. Additionally, if you are nearing age 59 1/2, "After Tax" contributions make even more sense as you will be able to access the funds penalty free at that age. And if you don't need the funds, they can grow tax-free for the remainder of your life.

Conclusion

401(k)s are today's retirement plan and Amazon's plan is quite attractive. For all Amazon Employees, the plan is well worth the look. I have extensive experience working with Amazon Employees to create a solid foundation for retirement. If you are approaching retirement in the next few years and would like help evaluating your options, I’d be happy to speak with you. You can schedule a Q&A call or contact me at chris@resilientam.com or (901) 318-3423 to go over any specific questions you may have about your situation.