My Firm at 5 Years Old

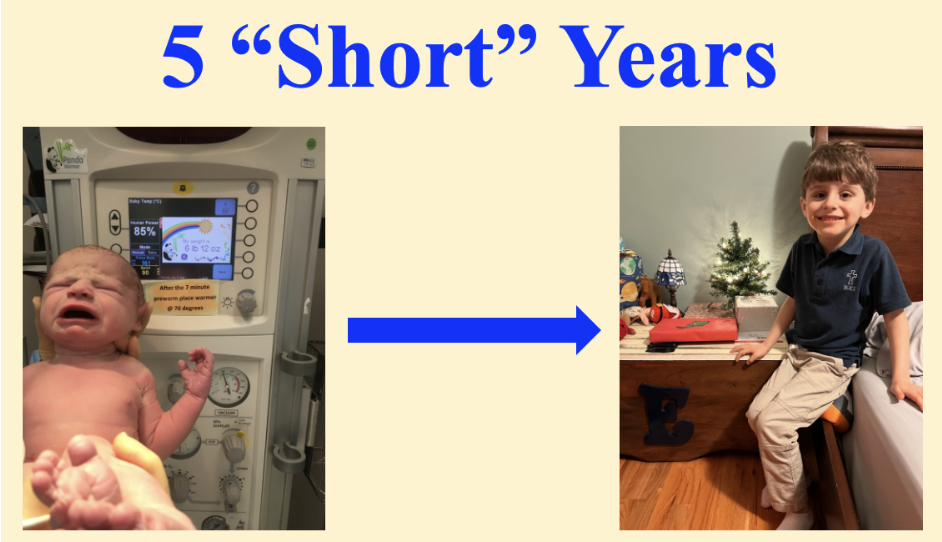

November 2021 marked the 5 Year Anniversary of my Firm, Resilient Asset Management. Like my son (pictured above), who is also 5 now, my Firm has experienced a bevy of changes. There have been many ups, some downs, great times, difficulties, and triumphs. I wanted to share a little bit of the story looking back from today.

Very Humble Beginnings

Somewhere in 2010, I completed my 15th year in the US Navy. I had flown a few thousand hours, trapped on various Aircraft Carriers a few hundred times, and seen many corners of the earth (including oceans) I would have NEVER otherwise happened upon. Among other realizations, considering the end of my Naval career bubbled to the top of the list.

Having been an amateur financial planner - with only one "Client" - I knew finance would be the "2.0 Plan". So, I took advantage of the military's Tuition Assistance Program and enrolled in an online Certified Financial Planner (TM) course. Correspondence courses were a bit less mainstream back then as compared to now. However, I powered through each of the 5 modules, passing each exam.

The coursework simmered for a few years before I revisited the topics prior to "sitting" for the CFP(TM) exam in 2015. That was an interesting time as my wife and I were also sweating an amniocentesis. Plus, the timing was just before Thanksgiving when we would be hosting Guests...needless to say, stress was pegged in the red. Happily, the amnio was fine, I passed the CFP(TM) Exam, and the visit was otherwise uneventful.

Getting to Work

After retirement from the Navy, I quickly realized going to work for someone else was not going to be to my liking. However, given that I had only been a professional pilot to that point, starting my own airline seemed somewhat inadvisable. So, I leveraged the only other qualification I had at the time - my having passed the CFP(TM) Exam. While I was not yet certified, I had passed the exam and felt confident enough to launch with no experience, no revenue, and no Clients - good times.

The launch of my Firm was only a few months after my son's birth. Obviously, a child changes you in many ways - I was no exception. For me, I found that Emerson focused my professional efforts as time became a bit more scarce once he was born. Of course, time management that takes a parent away from a child presents some rather difficult calculus. In my case, I found that founding my Firm probably resulted in my being around more for my son.

Firm Ownership

"A man who carries a cat by the tail learns something he can learn in no other way." - Mark Twain

This same statement applies to entrepreneurs - and to parents for that matter. While every owner wants each employee to THINK like an owner, at the end of the day, ownership is a binary thing. And when ownership for you is a 1 (not a Zero), your mindset is completely different.

With that added responsibility comes an absolutely incomparable amount of professional enjoyment. As the owner, especially when solo, you get to pick the name, the color, the design - it's all on you. For some, those pleasures mean absolutely nothing. To others, that freedom is all the difference...for me, it was indeed.

Getting to brass tacks, growth was not as simple as updating my LinkedIn Profile to tell the world I was available (for a fee) to give financial advice. In fact, doing just that resulted in absolutely no prospect activity whatsoever. Rather, for my initial growth I had a stable of contacts acquired through my time in the Navy who were aware of my professional transition. Fortunately, they were also in need of financial advice.

Revenue

For all anyone may read about starting a business, at its core, EVERY business needs a product for customers to consume. For me, since I decided to shun the sale of ANY products, my Firm's product was me, specifically my financial advice. Fortunately, the tides were shifting in the Financial Planning profession...

Where "Financial Advisors" used to sell stocks and more recently managed a portfolio of investments, the emerging value proposition for Financial Planners diverged substantially from investments. In addition to investment management, a new breed of Financial Planner focused on the other areas of Client finances - risk assessment, Tax Efficiency, Asset Location, and Estate Planning to name a few. These previously ignored areas were the "new thing" Clients needed in addition to, or perhaps instead of, investment management, which had been "commoditized". Fortunately, through both personal experience and professional education, I was well-suited to provide this type of advice - and advise I did.

While initial Prospect meetings were a tad awkward as people who were Friends were now considering a different sort of relationship, I have come to realize that if your product is needed enough, people will find you under a rock. True, advertising and word-of-mouth help A LOT, however, sooner or later you have to articulate your wonderfulness to Prospects. Happily, service delivery won the day and all of my initial cadre remain Clients to this day. I have found - from MY perspective - that serving as my friends' Financial Planner enhanced the relationship...over to them for THIER perspective.

Growth

One of the benefits of having few Clients is time. Because service delivery is relatively limited with very few Clients, more space is left for enhancing services, developing new techniques, refining procedures, prospecting, blogging, and all the other growth avenues available to the solo practitioner. Looking back, the services all my current Clients enjoy today are tied back to the professional "tinkering" I was able to do in the early months of the Firm.

While others have certainly grown much faster than my Firm, after about 18 months, the seeds of sustainability were planted and by about the 2-year mark, the green shoots of success had arrived. Year 3 hardened the roots of establishment that still exist to the present day. Not every day brought successes. In fact, most days were rather uneventful - some were professionally painful. In the end, I dutifully approached each day professionally optimistic of brighter days ahead, and indeed they were. Just as I say to Clients (and Prospects) who are willing to listen, there is MUCH to be said for simply putting one foot in front of the other - it works with long-term investments as well as entrepreneurship.

Resilient Asset Management at the 5 Year Point

Today We serve over 40 Clients, including a few children of Clients with whom our relationship is necessarily limited. Assets we manage have grown in concert with the overall stock market as well as through our own internal growth. The bedrock service delivery centers around the same 5 Core Areas for each Client - these will NEVER change at my Firm:

- Estate Planning

- Tax

- Risk Assessment

- Cash Flow

- Investments

Given our "high-touch, white glove" service, we are able to customize our services to suit our Clients' needs. Indeed, we are not the right Firm for everyone - though we don't have to be. Hyper-size and Hyper-growth are not our style and I seriously doubt it would suit our Clients, who mostly prefer to avoid touch-tone menus and waiting on hold while their "Financial Professional" that day familiarizes themself with their Clients' record. We don't need mass appeal to be successful. And even better, because we are 100% independent, we have been able to serve certain Clients to whom larger firms would never engage. Those Client relationships have come to be particularly rewarding.

What I Have Learned?

In short, a lot. However, I wanted to share 5 of the bigger lessons I've garnered:

1) You have to give entrepreneurship time

In my view, the #1 Reason a new Financial Planning Firm will fail is that the founder runs out of time. Meaning, Clients are unlikely to arrive on Day One. Therefore, the founder has to have alternate resources to sustain themself and the Firm while the Firm achieves sustainable velocity. A trusting and patient spouse definitely helps too.

For me, my military retirement benefits were an enormous part of the answer, with the medical benefits carrying most of the freight. Fortunately, I was pretty much otherwise financially independent too, thus I could take my time. Military Benefits and Financial Independence made my prospect meetings MUCH less pressurized and completely "un-sales-ey". Not only was this less stressful for me, it was supremely beneficial to my Clients....who wants to hire a Financial Professional who has financial issues???

2) The Glaring Need for Financial Advice

For better or worse, financial education in most curricula is either non-existent or woefully inadequate. And even worse, consumers enter certain markets - think Auto Sales, Home Purchases, or Life Insurance - only infrequently, so each is at a disadvantage to the purveyor of the desired "products". This is an unfortunate situation, which is only made worse by the emotion baked into the experience.

Some financial professionals have addressed this problem by creating various media to educate the innocent. Other individuals have Googled, read, watched, and researched their way to financial literacy. And others who I will call the "Delegators" are content to know they are not "experts", and even better, are content to seek out a professional for assistance. While I am certainly not an expert in EVERY area of personal finance, I am smart enough to know the "spots" where I can add value, and more importantly, I also know when to turn to another professional for guidance.

Everyone should seek to have a baseline level of financial literacy. When you want to delegate, seek out someone with whom you are comfortable and suits YOUR needs, not the other way around.

3) Keep Things Simple and Be Brilliant on the Basics

I estimate about 50% of the value I provide to Clients is simply keeping them organized. Before anyone shudders, you should know that "being organized" means different things to different professionals. Via my Firm's online server, we are able to consolidate all our Clients' financial lives in one central place. What before resided in various locations - each with different login credentials and the like - or even worse, didn't exist, now resides in once central, secure place for each Client. Moreover, each Resilient Asset Management Client has fingertip access to their financial information on-demand.

Our definition of organization also includes the accountability aspect of keeping the trains running on time in our Clients' financial lives - tax filing, retirement plan contributions, and reviewing estate plans are primary examples. And finally, we give Clients the reassurance that should something untoward happen to them, we are continually at the ready as a de facto continuity plan for them and their family. Our Clients find this a comforting aspect of our service delivery.

A large portion of the remaining 50% of my Firm's services consists of keeping things simple and being brilliant on the most basic "stuff". As a Combat Veteran, I can tell you that - from the sky anyway - well over 90% of the typical combat mission is administrative in nature. To be sure, there are periods of frenetic activity; however, that's a small portion. Personal finances are much the same.

I have found that keeping things simple and having a granite-like foundation rooted in relatively simple financial concepts carries an enormous amount of financial freight. Those romanced by the hyperactivity of meme stocks or options may enjoy periods of unprecedented success. However, those types of folks will not be a good fit for Resilient Asset Management.

4) Why a Home is so Important

Being in the military, you lead an itinerant lifestyle. Many members purchase a home and some of them are able to "homestead" for many years in one location. For the vast majority, purchased homes are either sold upon transfer to a new assignment or they become rentals. In short, during MY time in the military - almost half of which was spent living in foreign countries - I never developed an appreciation of what a home means to a family.

I have come to understand that not only is a home the focal point of nearly all family activity, it is also the nest within which monumental transformations and experiences take place. Therefore, while I am NEVER judgmental about any Client goals, my Client experiences have afforded me a much deeper appreciation of how important a family's home is and why. And I better understand the continuous desire for some to want to improve their homes.

5) Appreciating Runway

In completely different contexts, two people collectively tipped the scales toward me deciding to found my Firm.

First - I am not making this up - was Brock Lesnar. To the unfamiliar, Brock was an amateur wrestler extraordinaire who made the jump to professional wrestling - he was initially the "Next Big Thing". He successfully transitioned to the UFC (The MMA Promotion) where he was the heavyweight champion for a time...he went from pretend beating people up to doing it for real. In June, 2016, the UFC announced Brock would return to the octagon after a nearly 5-Year hiatus. In the build-up to the fight, Brock was asked "Why?", "Why now?" to which he said, among other things, "If you're gonna do it, do it now before it slips away", and "If I don't do it, I'll never know". To me, regretting something I never tried would be unbearable.

Second - while in the military, I was fortunate to meet Jane Wells...yes, that one! My first encounter with Jane was as a Seinfeld fan when she appeared on the final episode. In the following years, I was an avid follower of all her unconventional stories on CNBC and our paths virtually crossed a few times while I was stationed in Guam. In a similar vein to Brock Lesnar, Jane decided to pursue her own professional venture free of the "NBC Umbrella". I vividly recall her general advice to those with time to pursue their own dreams when the opportunities presented itself - do it!

Anyone contemplating a bold move can look to both of these individuals for both inspiration and guidance. For me, I listened to what they said and thought, why the hell not? In the worst case, I fail and then go to any one of a thousand Financial Planning firms looking for "talent"...trust me, there are many open positions. That is hardly a hollow fall back plan.

I know neither Brock nor Jane well, though I owe each a debt of gratitude. For those who need more "sophisticated" inspiration, I refer you to Robert Herrick and his "Gather ye rosebuds while ye may" quote. Whatever your motivations, I don't care who you are, you will NEVER know until you try. And my general feeling is most people dramatically underestimate what's inside themselves. Bottom line: in life, if something is the thing to do, do it.

Conclusion

The past 5 years have been an extraordinarily enjoyable ride. I have my Clients to mainly thank for the experience. I have also benefited from the many in my profession who so willingly give of their advice and experience, typically for free - @michaelkitces and @CPAPlanner come to mind - there are many others.

I have no idea what the future holds - strategic plans are less of a "thing" in an ink-dot-sized Firm like mine. What I do know is that I would not trade the last 5 years for any other professional experience...I am where I need to be. There is something about having your own shingle that inoculates some from ever wanting to work for someone else...count me among that VAXX'd crowd - I will never need a booster.